4 SaaS / Shopify App tips for today, to sell your app tomorrow

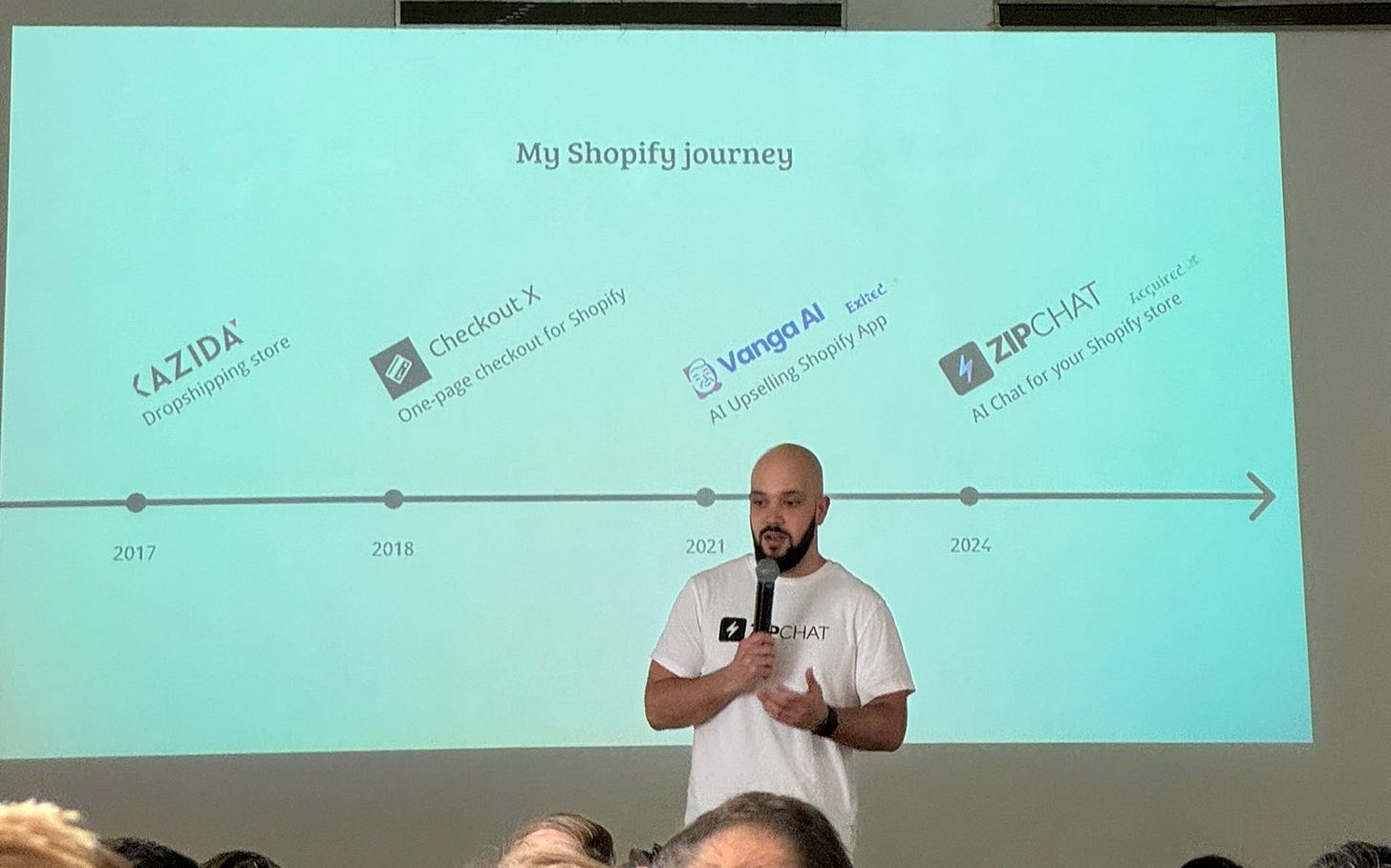

I was honored to speak in front of 150 Shopify Partners at Mat De Sousa’s Wide Event in Paris 🇫🇷 last month. Meeting all those people from the community I interact with online was such a pleasure. Can’t wait to see the rest of the community in Toronto 🇨🇦 @ editions.dev next week. 🤘

When we were deciding the topic of my talk, I thought to myself - we are living in an amazing time to be a SaaS/Shopify App maker. With platforms like Acquire.com, Flippa & others, it’s now possible to find someone to buy your code/customer base at any point of the entrepreneurship journey.

Before you needed to work hard, become really successful, and hope someone big buys you. Now you can just decide it’s time to move on, list your app, and find buyers.

SaaS & Shopify apps can now be considered “assets” and be counted towards your net worth, similar to how you would count your house or stocks.

I’ve been on both ends of such a transaction, I sold Vanga AI on Acquire.com, and recently I bought Zipchat off-market, so I thought it’d be useful to share a couple of tips that you can implement today, to get the best deal tomorrow, once you decide it’s time to move on.

Types of buyers

Before we discuss maximizing value, we need to define who we’re selling to: The buyer.

Buyers come in many shapes and forms, but we can separate them into 3 main categories:

The talent-oriented buyer

The talent-oriented buyer is an entity that doesn’t really care about your business but rather cares about what your team can do for them.

The strategic buyer

The strategic buyers are the Facebooks, the Googles, and the Shopifys of the world. Those are the buyers that you see in the news. They look for acquisitions that add “strategic” value to their overall business. For example, by acquiring Instagram, Facebook became much more valuable in the process, resulting in a much more valuable Facebook+Insta combo than what Facebook and Instagram would be worth individually.

Basically, strategic buyers are looking for a “1 + 1 = 3” equation, and because of that, they generally make acquisitions at higher multiples.

This is the best type of buyer that you can get, however, not every app has strategic value, therefore, this option is limited to a selected few.

The financial buyer

Financial buyers look to acquire apps with the hopes of collecting cash flow and/or growing the app and reselling it. They generally don’t have another agenda, they judge a business as an individual unit and are looking for a certain investment return. The good thing about financial buyers is that they have a wide pool of potential acquisitions, meaning they are way less picky. The bad is that they usually pay lower multiples than strategic buyers.

Because, you can actually seek out financial buyers proactively, exit on your own schedule, and sell any kind of app to them, I’ll be mainly talking about financial buyers as a target, although most things are also applicable to strategic buyers too.

Financial buyers are risk-averse

Any type of investing comes down to two main factors: Risk vs Return, and let me tell you - financial buyers ain’t VCs!

If you are a ( successful ) venture capitalist, you invest in 100 companies, 70% fail, 20% break even, 8% bring some returns, 2% bring 100x ROI and you make your money back, and then some!

Financial buyers, on the other hand, have a limit on how much they can earn from an acquisition. If they buy an app, maybe it grows 10% YoY, maybe 100%, but there’s no chance in hell that they’ll make a 100x return on investment. This also means that if any of their acquisitions fail, making up for it from other purchases will be extremely difficult.

Therefore, the most important thing for a financial buyer is to not lose their investment.

When you are selling your app, you have context, you know how hard you worked, you know how good your product is and you know that you have a strong business, however, the buyer doesn’t know that. While you see an app that will continue growing, the buyer sees all kinds of potential threats that can kill the app and throw their money down the drain.

So, in order to sell to a financial buyer for a good price - you need to appear as a safe investment.

Tip 1: Have the right type of revenue

Financial buyers care about finances. With this kind of buyer, your acquisition price will always be calculated as some kind of multiple on your revenue. However, not all revenue is made equal.

There are three types of revenue: Recurring revenue, Usage-based revenue and One-off revenue, and your business will be valued differently based on the kind of revenue you have.

Buyers ❤️ recurring revenue. MRR is the holy grail of SaaS and buyers see it as an “almost certain” cashflow that will hit their bank account every month. On the other hand, one-off revenue is not money they’ll be getting on a monthly basis, it’s a historical record of what you earned in the past, which may repeat or may not repeat, nobody knows 🤷♂️

And there’s “usage-based” revenue which is somewhere in the middle. It’s kind of recurring as customers pay for usage every month and it’s kind of seasonal as there is no guarantee what customers will pay the next month. Both Checkout X and Vanga AI relied on a usage-based revenue model and trust me - it always brought arguments to the table. As a seller, you’ll always have to argue that usage-based is “just marketing” and it’s really recurring, while the buyer will always argue it’s actually seasonal and not recurring.

If you can take one advice from me, it would be to avoid usage-based revenue and push for recurring plans as much as possible, in order to get the best valuation for acquisitions, investments, loans, etc. At Zipchat, we charge per number of replies & number of pages, but those are packaged into different plans. Only if the merchant surpasses their plan limit and doesn’t upgrade, we apply a small amount of usage charges to make up for the difference:

Tip 2: Understand and document your numbers

I often give consultations to Shopify App / SaaS founders and truth be told, most don’t know their business metrics. The same goes for most apps listed on platforms like Acquire.com or Flippa -> the majority don’t provide any business intelligence besides a Stripe / Shopify Partners screenshot. Guess what this makes them look in the eyes of a potential buyer - risky and unprofessional.

Make Profit and Loss statements on a monthly basis

A P&L statement is a simple sheet that tells you, how much you made, how much you spent, what you spent it on, and if you made a profit or not. A simple document of great importance.

Whenever you list your app for sale and show your numbers, you’ll be sharing a snapshot of your business. A single dot in time. But buyers don’t buy dots, they buy lines, therefore they need more context and data points, in order to see what the direction of the business is like.

They want to know what happened, did the business grow, did it lose money while growing, and what happened in order for the app to arrive here?

In theory, you can make those retrospectively, but it’s not always that simple, especially if you have multiple apps within the same company.

Plus, it helps to know what your bottom line is on a monthly basis.

Understand your churn

CHURN! Everybody talks about it, but almost nobody understands it.

There are so many ways to measure churn that I feel it’s unnecessarily complex. Especially in Shopify where you have double churn ( Shopify churn + your churn ).

Ignore all that, and ask yourself this: If I stop accepting customers today, how much time will pass until I don’t have any revenue? ( It’s an oversimplification )

Every buyer will be worried about churn, so you need to show them that:

You understand your churn

The churn is manageable

Understand your customer acquisition cost

How much does it cost to get someone to become a customer of your app? Even if you grow “organically”, this value is never zero. Maybe you make SEO / ASO, maybe you create content, maybe you employ salespeople, maybe you make onboardings -> no customer comes for free.

Buyers want to know what this cost is so they can understand what’s the ROI from each customer.

Understand your customer's lifetime value

The other component for the ROI -> How much money do you earn per customer?

No customer stays forever, so there is a finite revenue that each customer will bring.

Those are some of the metrics that a buyer will want to investigate to assess your business. In general, you want to have good business intelligence so you don’t leave any room for speculation from the buyer’s perspective. Again, buyers are risk-averse, so anything that isn’t well documented will be perceived as risky and will eat off your valuation.

For Shopify devs, Mantle gives a good BI starting pack that you can implement easily.

Tip 3: Build a repeatable growth machine

I talk to many Shopify app founders, and when asking what they do for marketing, most of them answer “Nothing”. And they are proud of themselves…

There is nothing to be proud of. Buyers need to be masters of their own faith and need to be in control of their acquisition.

If you really “do nothing” and customers find you via searching Google / the app store, this poses an existential risk for the app, as the buyer won’t have control over the acquisition channel.

To be clear, I’m not saying Google Search or the Shopify App stores are bad acquisition channels.

They are probably the best acquisition channels in terms of ROI if you can get them to work. I’m saying that you need to understand what makes you rank well, and what you need to do to stay there. And ranking ain’t easy, so for sure you are doing something right - getting backlinks, getting reviews, optimizing content, etc. Document a repeatable process!

At Zipchat we’re not trying to get customers at any cost. We want to build a repeatable growth machine that can be used to attract new customers with predictable results.

Tip 4: Be replaceable

Even if you decide to stay on after the acquisition, a buyer needs to be able to run the business without you, so they need to know that they can replace you.

Document everything

Nobody likes folklore - knowledge that is transferred from person to person. But, if you show robust documentation of your processes and app, you will make a great impression on the buyer.

Separate roles

Even if you wear many hats, it’s still a good idea to define processes with “different” roles. This is because it’s easier to find a specialist to do a particular job instead of finding a polymath who can do many things at once. You might be doing everything from design, to code, to support, but a buyer would probably want to hire different people for each part of the process.

Delegate specific “know-how”

If your business has some kind of specific applied knowledge that most people don’t have, it’s a good idea to either have someone on the team who can do it, or build a network of partners to aid with the know-how. From my experience, those are usually some kind of services or white-glove onboardings that the founder provides on top of their product.

Some examples that come to mind are: Setting up Google Shopping Feeds, Manually optimizing a site’s speed, etc.

To be clear, “Coding” or “Sales” are not specific know-how.

Don’t be overdependent on founder-led growth

Founder-led growth is a great strategy to attract customers, however, if that’s the main growth channel, what happens when you leave?

A business needs to keep the same rate of attracting new customers to stay at the same place. If new customers stop coming, churn starts eating the business.

When it comes to selling the business, founder-led growth can potentially be a problem and you need to have a really good transition strategy to get away with it.

Conclusion

I hope my tips prove useful, that you implement at least some of them, and that they help you attract more potential buyers, at better conditions. Let me know if they do, and perhaps you can send me a pack of beer 🍻 once the time for exit comes.

Just remember, those tips are icing on the cake - the most important thing is building a great business with strong MRR and healthy margins. 🤘